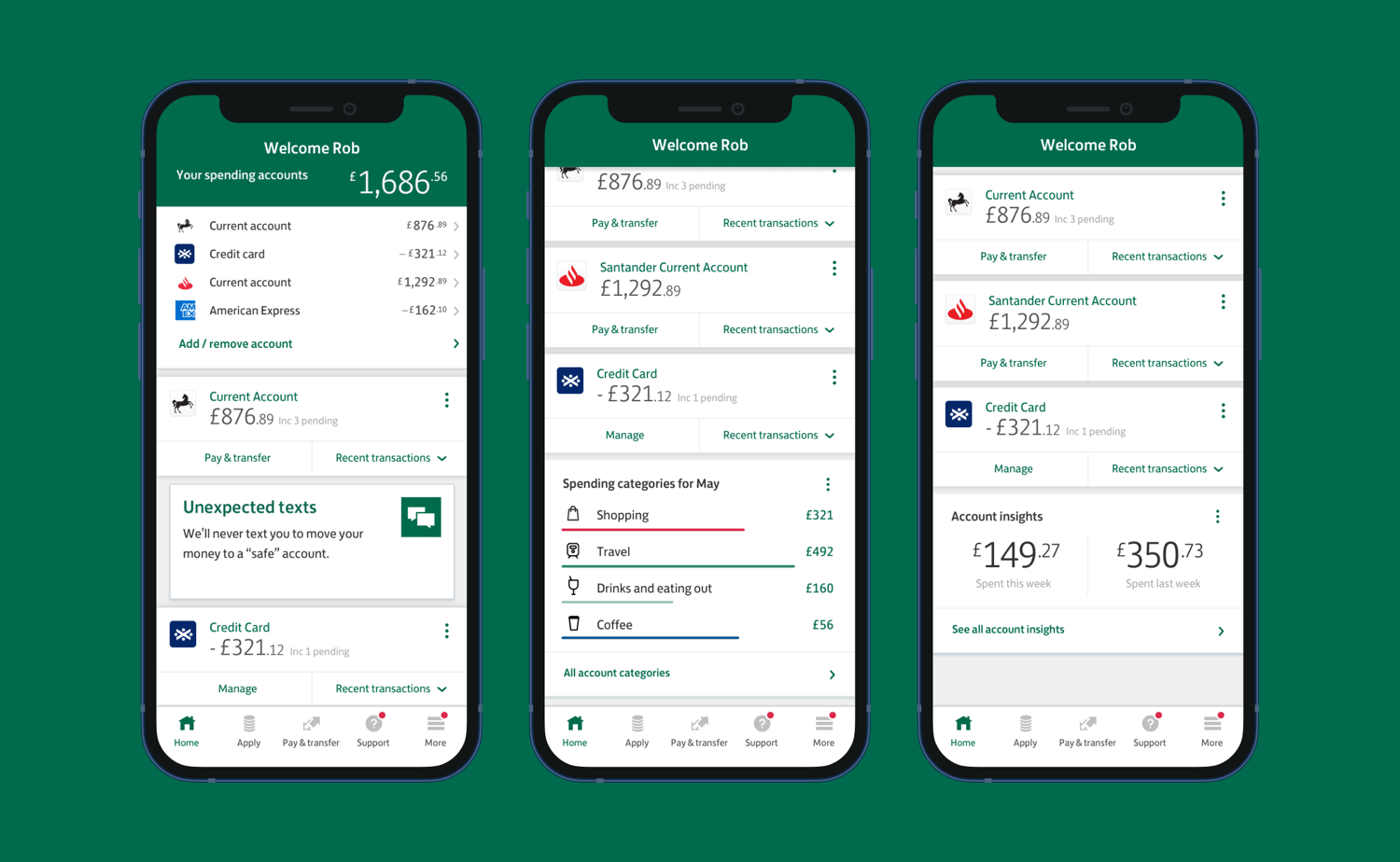

Open banking:

All your accounts

in one place

Open Banking was a new UK regulation change in 2018 that was introduced to give you more control over your data and ability to handle all your banking accounts from different providers in one place.

Services

- Financial servies

- Banking

- B2C

- User workshops

- User testing

- Concept testing

- Product design

- Mobile design

- UX Design

- UI Design

This regulation change was widely seen as a huge positive step for consumers and the ongoing rise of challenger banks is evident that users are wanting to be more engaged with their banking and finances. I joined the Lloyds design team for 6 months to help lead them along this discovery journey.

Goal

How can we communicate the ability of Open Banking in a way that brings purpose and meaning to the user.

Competitor analysis

Initial first hand research was carried out to understand the banking landscape, looking at traditional banking apps, challenger banks and other banking related apps. We were interested in seeing the motivational trade off between challenger banks have risen up in popularity with a strong focus on user experience, smaller teams and being able to move faster and traditional banks having a longer history, typically accessible on the high street and a sense of security.

Working with their UX researchers, we defined user problems from their empathy maps they’ve built up over time from regular inhouse user interviews to start brainstorming some new solutions.

- Carefree - Overwhelmed, impulsive, reactive, head in sand and living in credit

- Maximiser - Saving goals, spending on credit cards for rewards

- Budgeter - Creates budgets and tracks spending, in control but unsure for future

- Delegator - Living day-to-day, checks daily and wants to make money work harder

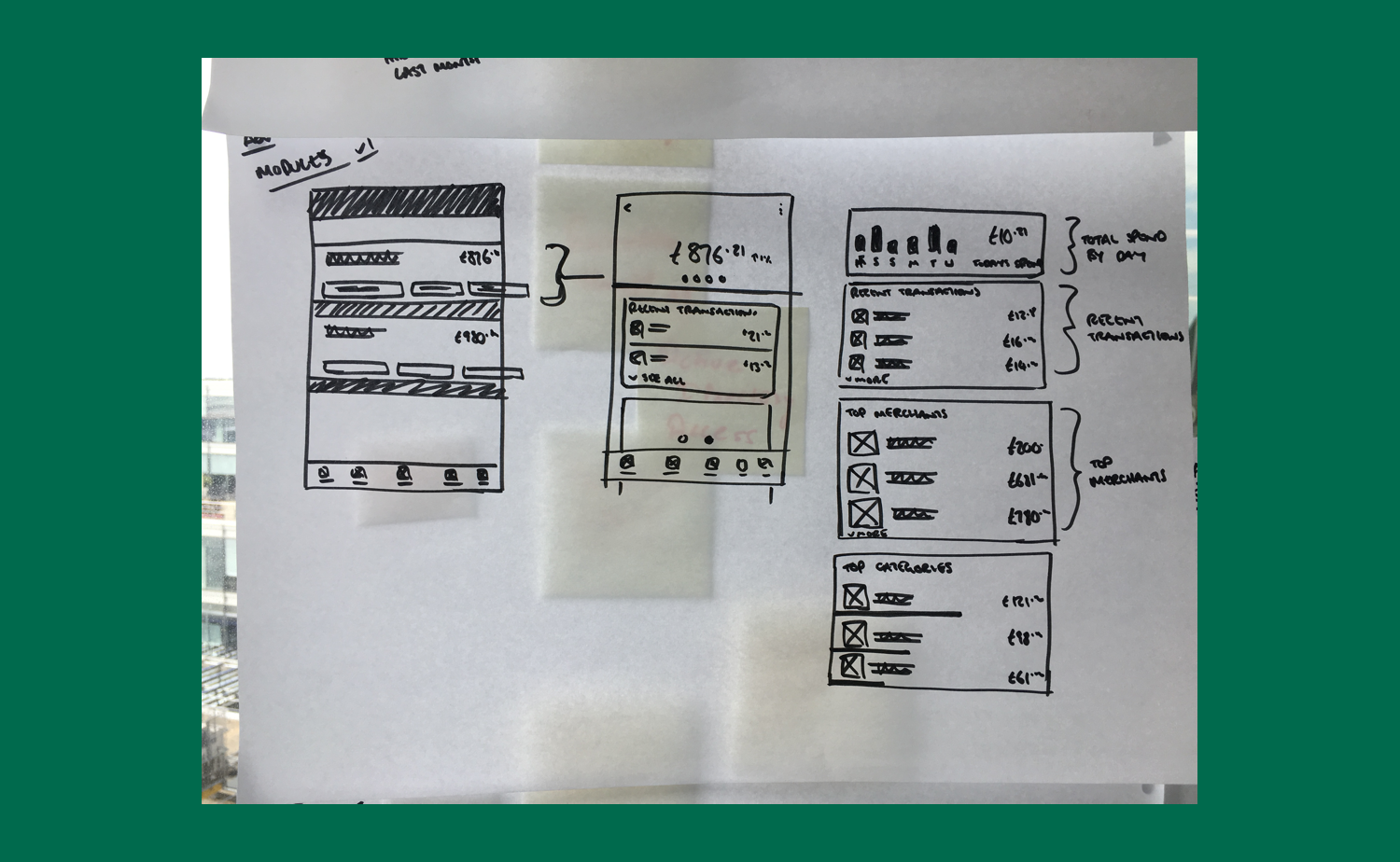

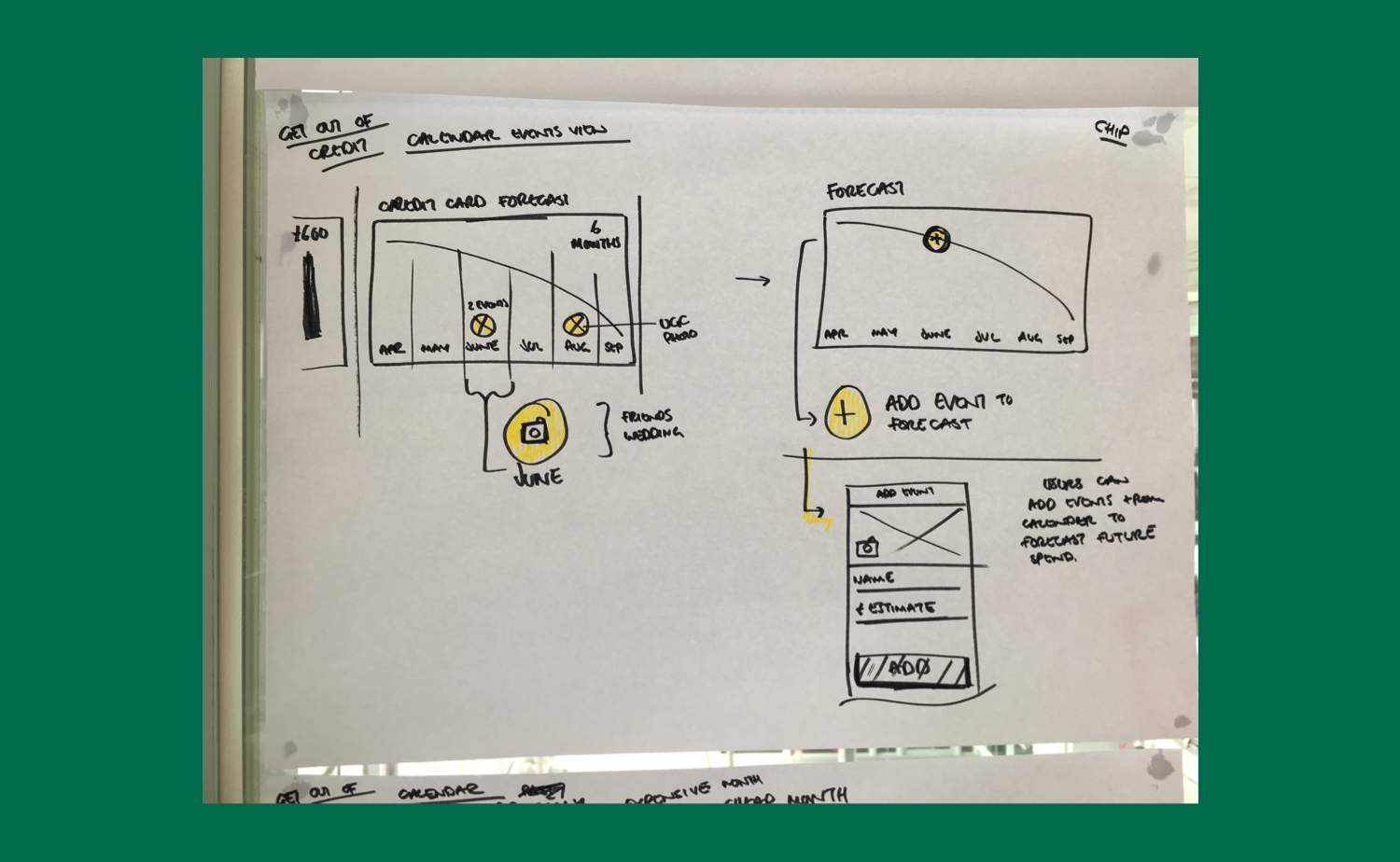

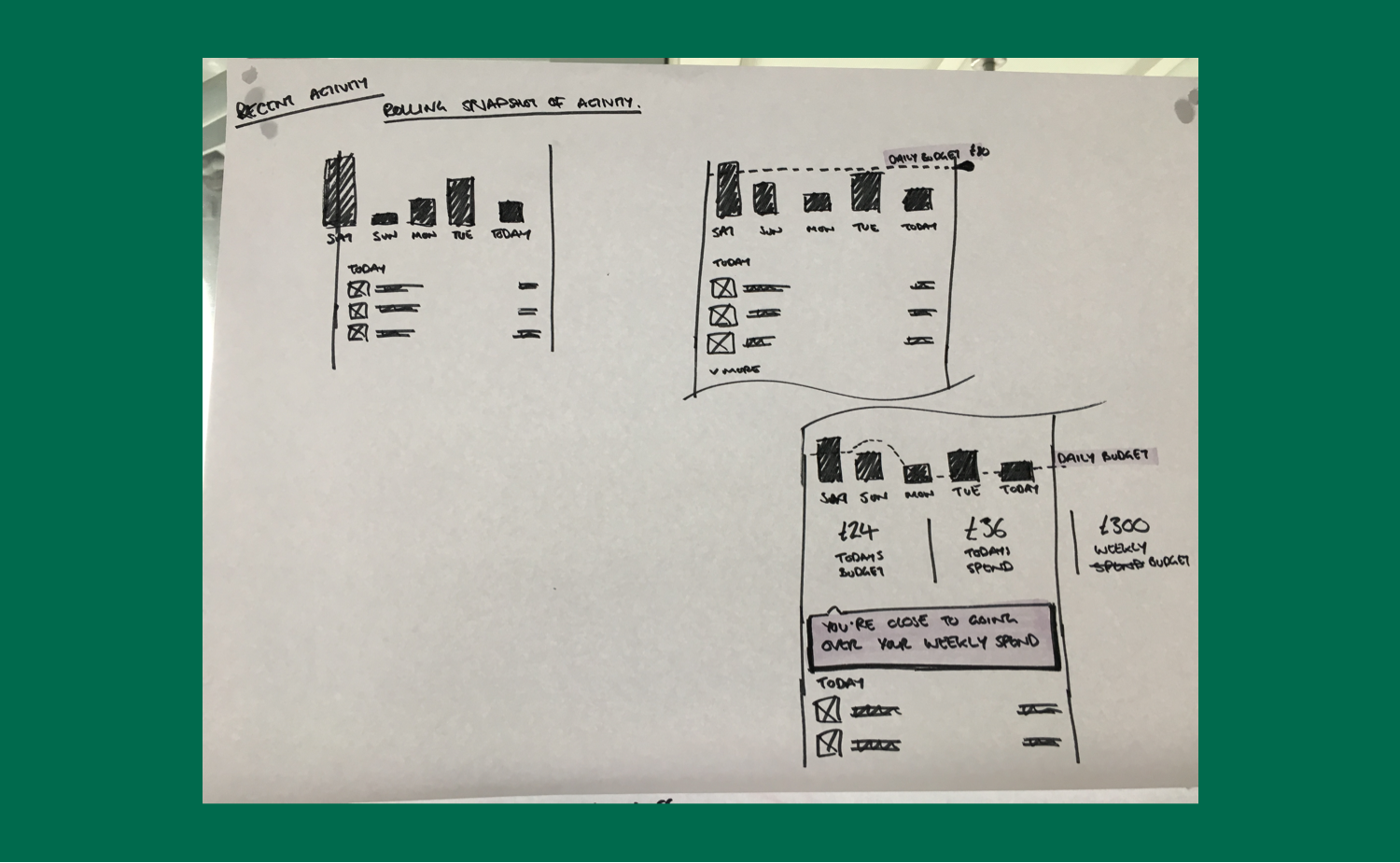

Prototype & test

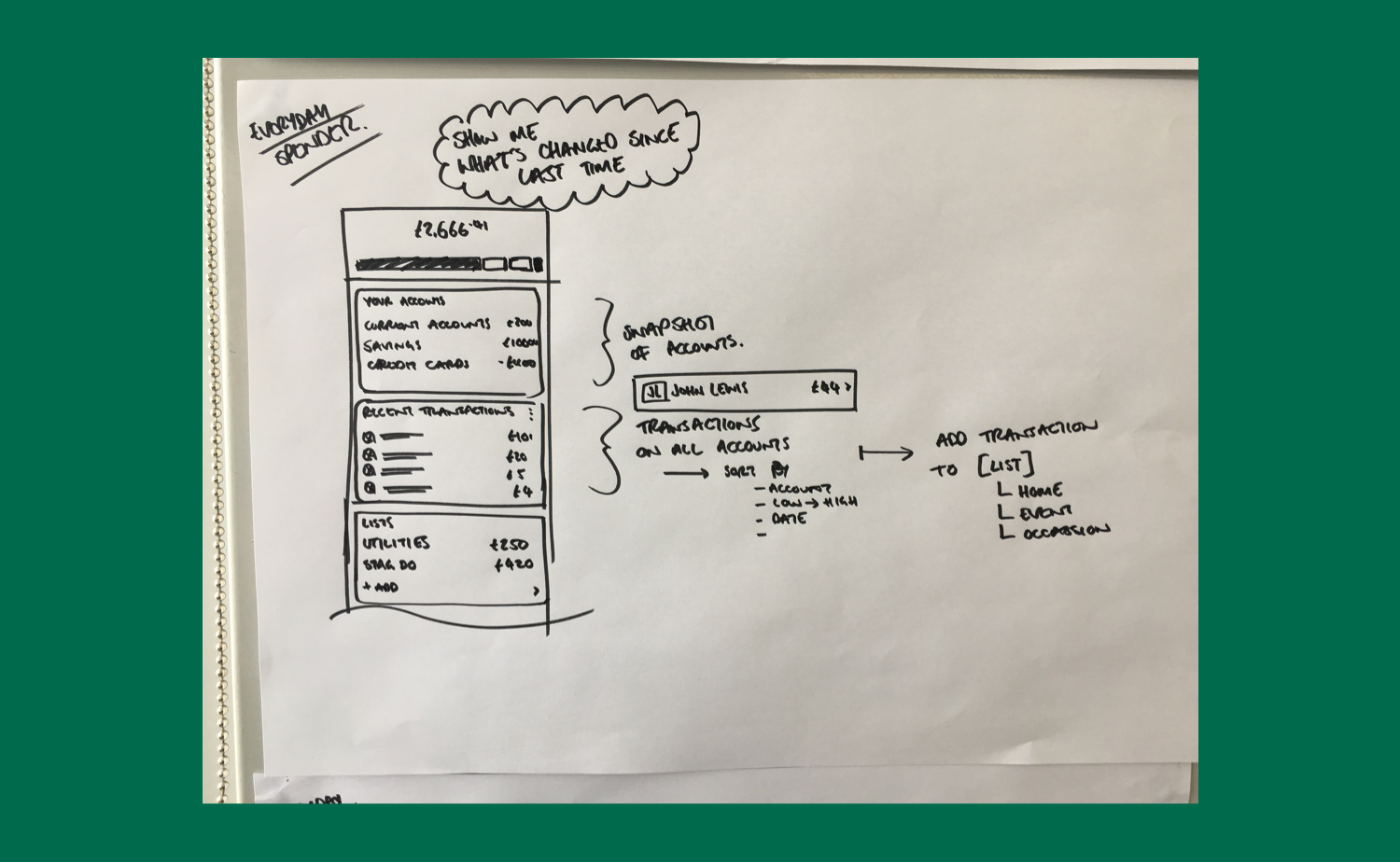

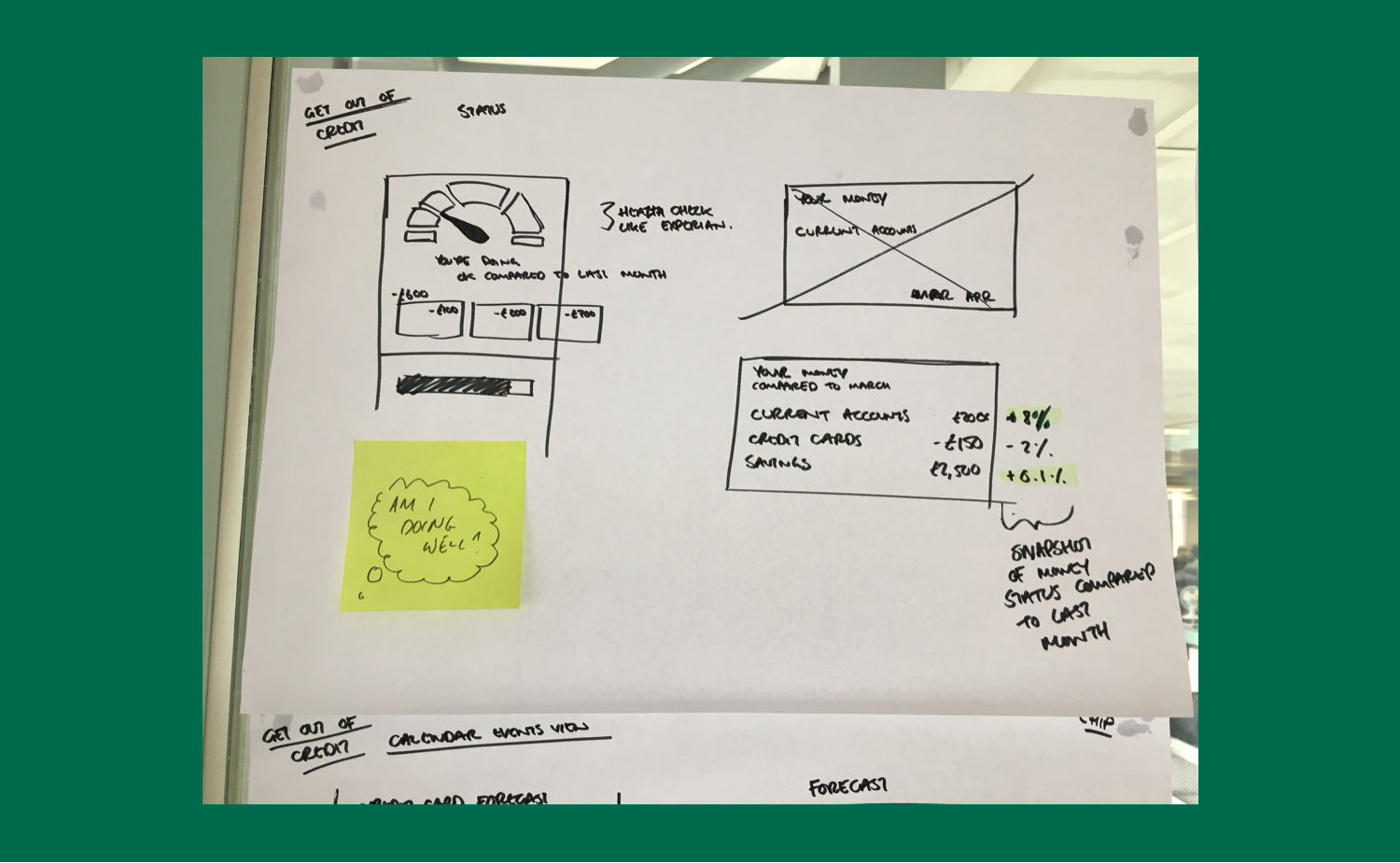

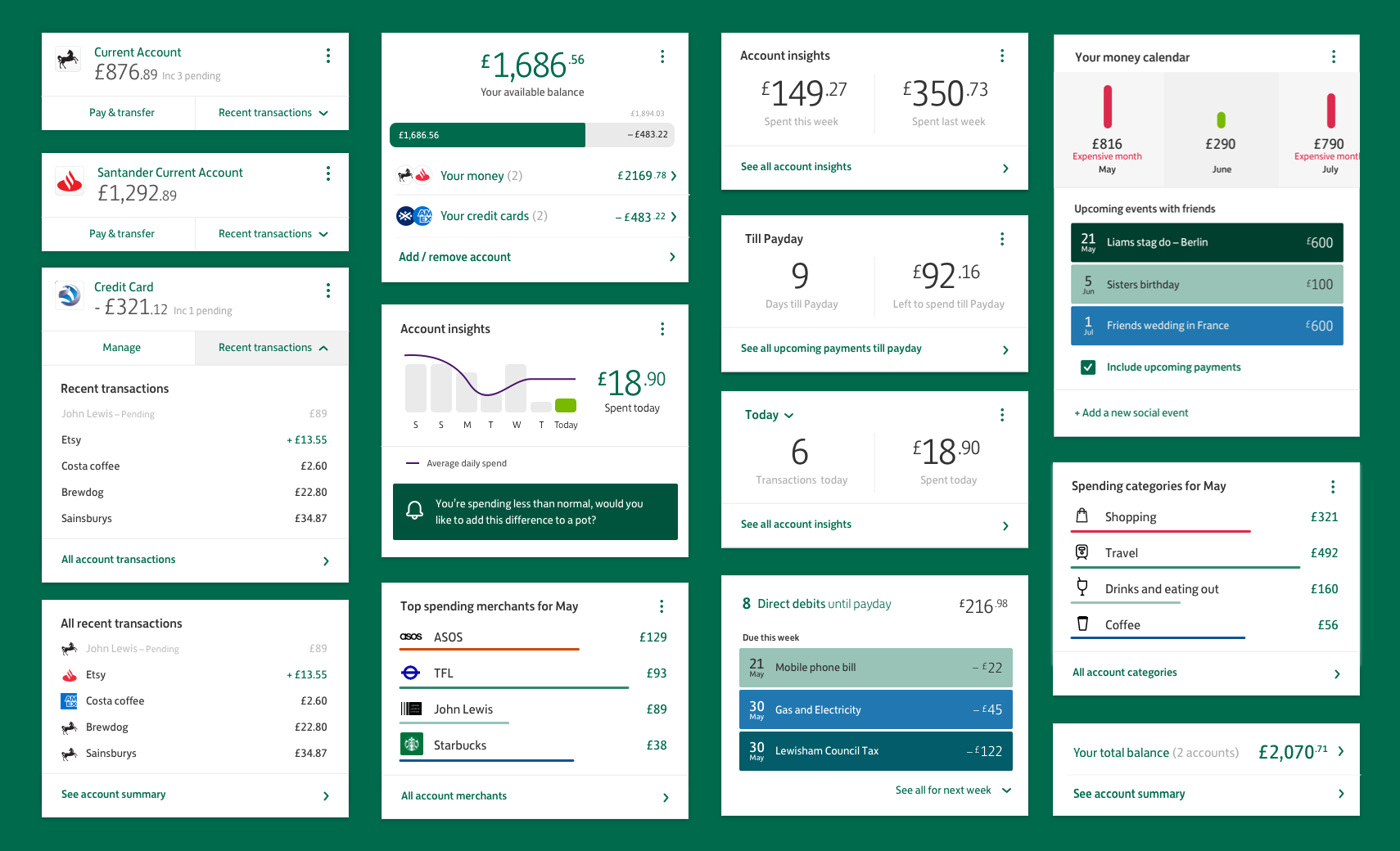

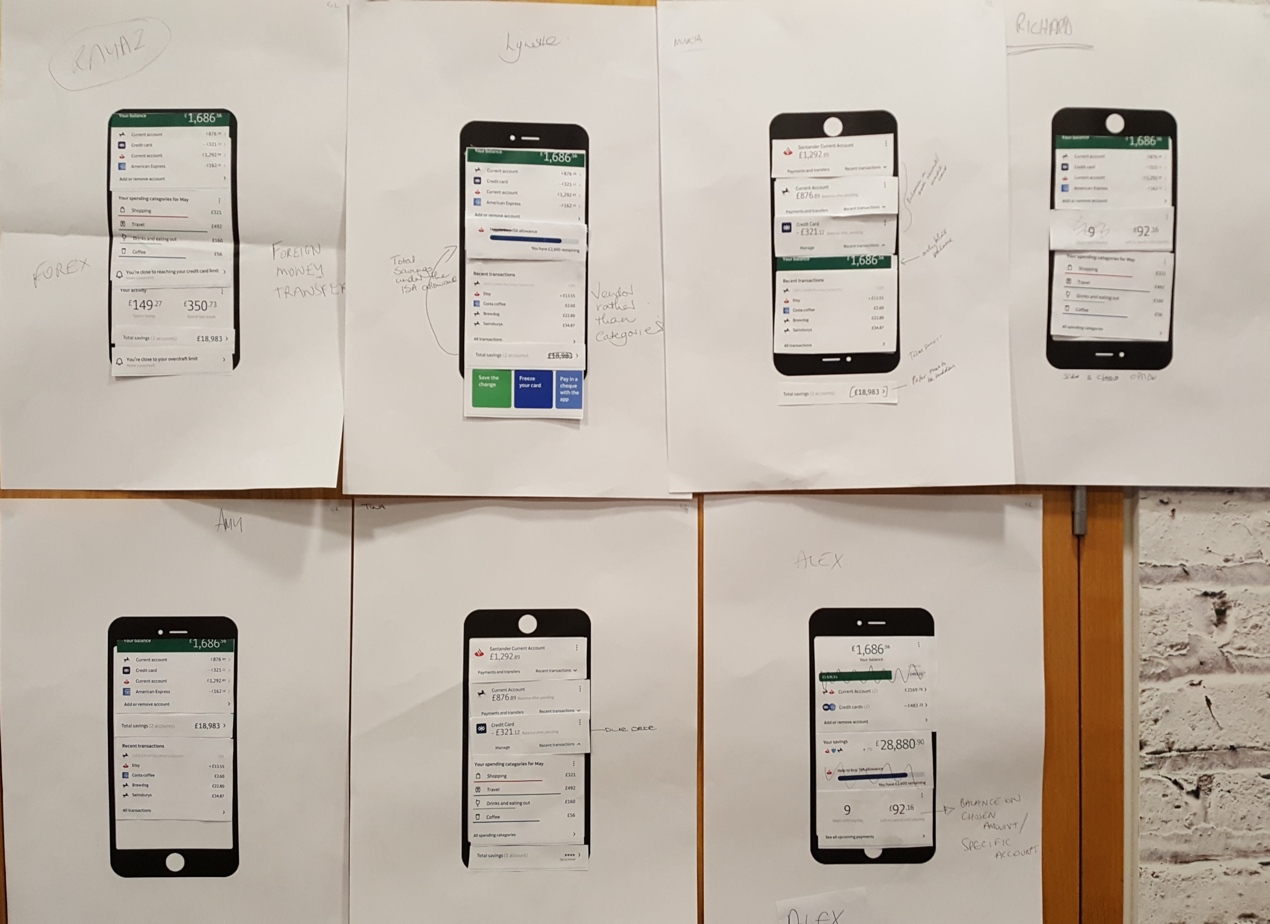

Leading their design discovery journey we started sketching up solutions to the user problems and thinking deeper with all your accounts being in one place. These took the form of a series of money tiles that would be interchangeable and for us to go on to test, asking our participating users to create their own money dashboards.

User stories

This would help us build a richer practical picture of how users are interacting and visualizing their money and lead us to write user stories.

Use case 1: Aggregated balance across current accounts

As a customer with multiple added accounts

I want to view aggregated balance of all my current accounts in a single place with the ability to drill down individual account balances

So that I can get a holistic view of my money without having to log into multiple banking apps

Use case 2: Last day transactions

As a customer viewing aggregated balances

I want to be able to view the last transaction across each of my current accounts

So that I am well aware of the most recent activity on my account

Use case 3: Spending trend

As a customer using mobile app

I want to be able to view my spend this week in comparison to the last week across all my current accounts

So that I can plan and better manage my money

Conclusion

Talking about money is complicated and intricate and needs to be approached with empathy at the heart to really connect with people's needs. The outcome of this design journey is just the start of a thread of ongoing tools to help users take control and feel confident in their financial decisions.